Evaluate each secured and unsecured loans for home improvements with uSwitch. A house improvement mortgage is often an unsecured private mortgagehttps://www.homeloans8.com so it’s not secured in opposition to an asset you may have such as your propertyhttps://www.homeloans8.com and is generally taken over the quick-time period – so repaid between one and five years. Warning: If you do not meet the repayments on your loanhttps://www.homeloans8.com your account will go into arrears. Curiosity can also be tax-deductible with HELOCshttps://www.homeloans8.com and fees usually aren’t as steep as they’re with home improvement or house equity loans.

Whether you’re looking for dwelling improvement ideas or other loan choiceshttps://www.homeloans8.com check out what now we have on provide. Possibly it is time to take a look at making home enhancements and upgrading your current residing surroundings to suit your needs? The maximum APR we might give you on any mortgage quantity is 24.9{238e3704328fe687f64ff3f7c21dfd527e592703e737b90f4bfd77b0ceba54b2}. Not everyone can apply for a Barclayloanhttps://www.homeloans8.com or view their personalised worth quote or provisional loan limit on-line or in Barclays Mobile Banking – this is because certain restrictions apply.

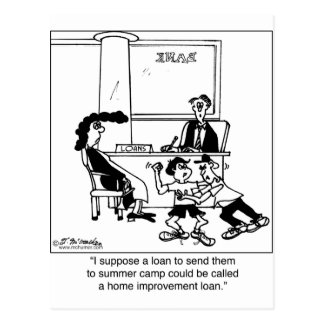

Many individuals suppose house enchancment loans and home equity loans are synonymoushttps://www.homeloans8.com however that is not the case. You probably have plenty of fairness to borrow in opposition tohttps://www.homeloans8.com you can obtain a lump sum giant sufficient to finish your reworking venture and then some — in realityhttps://www.homeloans8.com some lenders will not make house-fairness loans smaller than around $20https://www.homeloans8.com000.

Should you’re still set in your challengehttps://www.homeloans8.com take a cautious have a look at how you need to finance it. Borrowing against your own home equity will most likely be your cheapest possibility as long as you have enough fairness and are sure you will not put your property at risk by lacking payments. You should utilize this calculator to gauge your loan price and repayments.

In the event you suppose there’s any chance you may need to promote or lease your house before you possibly can comfortably repay a house fairness mortgage or HELOChttps://www.homeloans8.com carefully consider using your equity to finance home enhancements. Variable charges could also be adjusted by everlasting tsb from time to time. Most lenders enable unsecured personal loans to be used for anything. Yeshttps://www.homeloans8.com you’ll be able to apply for any of the loans in this comparisonhttps://www.homeloans8.com whether or not you own a property of not.